Click Here for the best range of Amazon Computers

Click Here for the best range of Amazon Computers

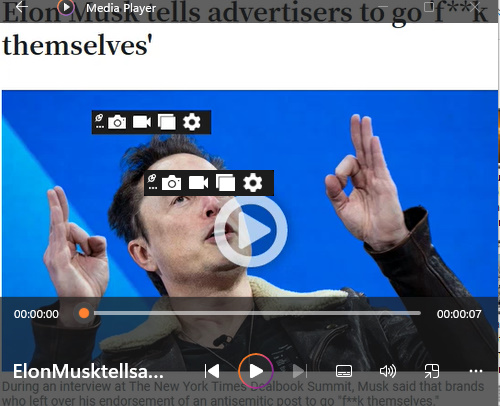

More advertisers may flee X following a tirade by CEO Elon Musk

Elon Musk lashed out at some of the biggest brands for dropping the platform.

Elon Musk apologised for his post while speaking at a New York Times DealBook event

- Elon Musk tells X advertisers to go 'fk themselves'

Click Here for INL News Amazon Best Seller Books

Elon Musk tells advertisers to go 'fk themselves

Elon States That He Will Not Be Blackmailed By Advertisers

Click Here for the best range of Amazon Computers

Click Here for INL News Amazon Best Seller Books

Elon Musk's Family Is Richer Than You Think

Amazon Electronics - Portable Projectors

Click Here for INL News Amazon Best Seller Books

Click Here for INL News Amazon Best Seller Books

INLTV Uncensored News

INLTV is Easy To Find Hard To Leave

YTweet.org

"Elon Musk takes control of Twitter in $44bn deal - BBC News"

https://www.bbc.com/news/

Elon Musk takes control of Twitter in $44bn deal

By James Clayton & Peter Hoskins

BBC News 28 October 2022

Remember When Yahoo Turned Down $1 Million To Buy Google?

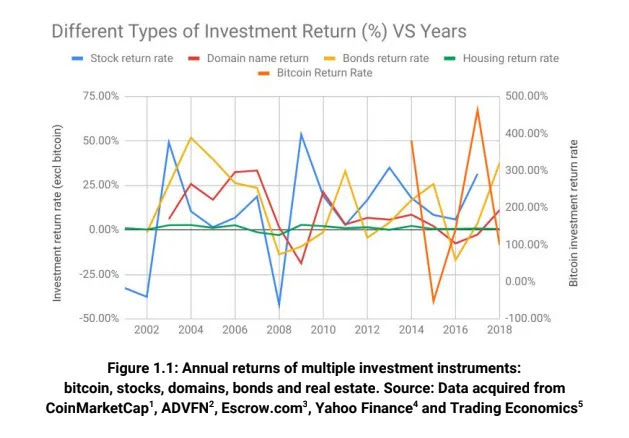

SAN FRANCISCO (Business 2.0) -- Real estate prices might be falling in some areas - but that's for physical real estate. Virtual real estate, in the form of Internet domain names - the part after the "www" in a website's address - is on a tear and showing no signs of slowing down.

By some estimates, the market for registering and trading domain names could reach $2.5 billion this year.

Real more below on this webpage

Are website names the new real estate?

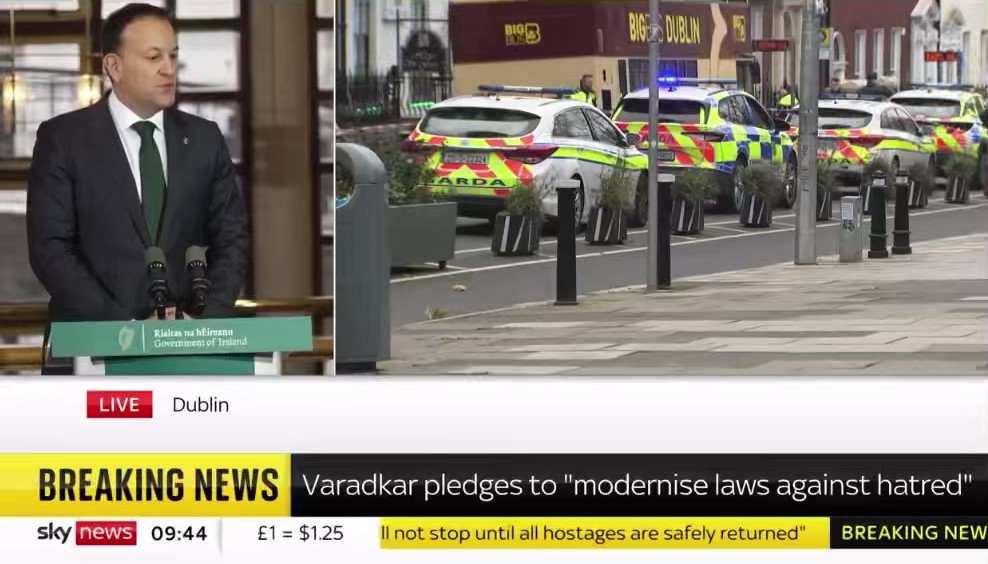

Dublin Riots: 'Elon Musk knows nothing about it'

Dublin Riots: ‘Elon Musk knows nothing about it' | Newstalk

While taking an interest in Irish politics and recent events, Elon Musk knows "nothing" about the country, according to a Wired reporter.

David Gilbert told The Anton Savage Show leading Irish far-right figures online have developed close relationships with their counterparts across the pond.

Mr Gilbert said one man in particular has been very successful in developing these relationships.

“Central to this is a guy called Keith O’Brien from Roscommon who is known online as Keith Woods,” he said.

“Over the course of the last couple of years, he has made friends online with a lot of high-ranking or important far-right figures in the US. Including Nick Fuentes who’s the head of the America First movement, and crucially, Elon Musk.”

Elon Musk

Elon MuskThe Wired reporter said this led to the owner of X, formerly known as Twitter, becoming an online commentator on last week's riots in Dublin.

“When all this broke out on Thursday [November 24th], Elon Musk just had to get involved. There’s nothing he doesn’t want to stick his nose in, even though he knows nothing about it,” said Mr Gilbert.

“He turned to Keith Woods [for information] who has built up a huge following by positing antisemitic content on Telegram.”

Mr Gilbert said the Roscommon man painted a certain picture for Elon Musk as to what is going on in Ireland.

“What [Keith O’Brien] was saying was that the riots in Dublin were just a result of the Government ignoring what he and other people have been saying about immigrants coming into the country,” he said.

“That led Elon Must to Tweet about it, and then Conor McGregor got involved before it quickly filtered out to all of the other blue checkmark guys on Twitter.”

“As a result, we’ve got huge swathes of the US far-right talking about Ireland in terms that show they really don’t know what they’re talking about.”

US interest in Ireland

Mr Gilbert explained the motivation for US figures such as Nick Fuentes, Tucker Carlson, and Steve Bannon to speak about Ireland.

“Fuentes and the others have been pushing this narrative that immigration is the biggest threat to the American people,” he said.

“They all believe that the American Government, and governments around the globe, are pushing this campaign to replace native populations with immigrants.

“This is a grand conspiracy that’s been around for decades but has been ramped up by these figures in recent years.”

Growth of Far-Right in Ireland

Mr Gilbert said the far-right in Ireland have recently adopted this way of thinking.

“Over the last six months, we’ve seen a huge uptake in protests and violence around direct provision centres in Ireland.

“We’ve also seen allegations of vigilantism in little towns and villages around Ireland.”

The Wired reporter added that these US figures are talking about immigration in Ireland to further their own goals of “making people scared of immigrants”.

Listen back now:

Rise Of The Far-Right In Ireland The Anton Savage Show 2-2-23

Elon Musk has a big X on his back as Bob Iger pulls ads from platform (msn.com)

Bob Iger needs all the friends he can get, given what’s on his plate as CEO of the increasingly unstable House of Mouse.

Consider: Activist investors are swirling, his stock price has cratered, and consumers are shunning Disney movies.

He’s still mired in a battle with the Florida governor who took away Disney’s self-governance perk known as Reedy Creek because of its overt progressivism.

All that, yet Iger decided he needed to pick an absurd fight with Elon Musk.

Iger recently went public with his decision to pull ads from Musk’s X (formerly known as Twitter) social media platform, joining others in the progressive CEO class attacking someone the left hates as much as Donald Trump.

The overarching goal of the progressive movement, if you haven’t noticed, is destroying the platform Musk is trying to remake from the lefty safe space it had been for far too long to a free-speech mecca.

No more silencing of conservative voices, no more taking orders from the lefties in the Biden administration.

With that, Musk, despite being the world’s richest man, had a big “X” on his back.

Recently, Musk himself made it larger when he clumsily endorsed a crude tweet that suggested something vile and antisemitic: that Jews were behind a theory to replace white people.

The trolls insist Jewish people are getting their just rewards with the outpouring of antisemitic hatred on the streets following the Oct. 7 Hamas massacre of Israelis near Gaza.

Then came a report from the Soros-backed lefties at Media Matters that said X places noxious content from neo-Nazi users next to ads of major companies like Disney, leading to an ad boycott and money drain that threatens X’s existence.

Iger, at last week’s New York Times DealBook conference, seemed to relish X’s demise.

He took the lead in publicly upbraiding Musk, and squeezing the company’s ad-revenue base even further.

“By him taking the position that he took in quite a public manner,” Iger said, “we just felt that the association with that position and Elon Musk and X was not necessarily a positive one for us. And we decided we would pull our advertising.”

Musk’s X posting was dumb (he said as much at the same conference) but a fairer reading doesn’t put him anywhere close to the antisemitism being displayed by elements of the Democratic Party who are all but celebrating the Oct. 7 massacre — without a peep from the Disney boss. As for Media Matters’ “investigation,” it’s about as solid as Disney’s shaky stock price; Musk’s programmers say the left-wing provocateurs manufactured the situation they accused X of fomenting. Musk and his lawyers are now suing for defamation. The bigger issue for Disney’s shareholders is whether Iger understands what battles he needs to pick.

Iger, of course, was the longtime CEO of Disney, a legend in media and entertainment before stepping down as chief executive in 2020 (he remained as chairman until 2021) and giving the company over to his chosen successor, Bob Chapek.

Iger was lauded for his deal-making, stock-price performance — and for his progressive social activism virtue-signaled from his C-suite that was cheered by the liberal cultural establishment.

Lefties in charge

As my book on corporate wokeism — the forthcoming “Go Woke, Go Broke” — demonstrates, Chapek was ultimately forced out by the company’s left-wing corporate infrastructure in part because he initially sought to change the culture Iger had left him. No surprise that when Chapek got the ax in late 2022, the board of Disney brought Iger back and he picked up where he left off. Except it wasn’t that easy.

His deal-making wasn’t that great; it saddled Disney with lots of debt at a time when consumers weren’t rushing to watch its woke movies or pay all that much money for a trip to woke Disney World.

Shares of Disney are down nearly 20% over the past five years, and aren’t recovering.

In a recent filing to investors, the company disclosed that its progressive stances are taking a chunk out of its bottom line because “consumer perception of our position on matters of public interest, including our efforts to achieve our environmental and social goals, often differ widely and present risks to our reputation and brands.” Musk’s response to Iger’s virtue-signaling also made a lot of news because it was both priceless and typical Musk.

“If somebody’s going to try to blackmail me with advertising, blackmail me with money,” he responded also during the Dealbook conference, “go f–k yourself. Go. F–k. Yourself. Is that clear? I hope it is . . . Hey, Bob, if you’re here in the audience. That’s how I feel.”

I am told Musk’s people at X are feverishly looking to change its business model, moving the platform away from paid ads by big, woke corporations like Disney. It won’t be easy and it’s a work in progress to monetize X’s reach with small businesses, and even with a payment service along the lines of PayPal (Musk was one of its founders). Iger, meanwhile, should be worrying about Disney’s woke and increasingly unprofitable business model.

He’s got bigger issues to deal with than picking fights with Elon Musk.

The world's richest man, Elon Musk, has completed his $44bn (£38.1bn) takeover of Twitter, according to a filing with the US government.

Mr Musk tweeted "the bird is freed" and later said "let the good times roll".

A number of top executives, including the boss, Parag Agrawal, have reportedly been fired. Mr Agrawal and two other executives were escorted out of Twitter's San Francisco headquarters on Thursday evening, said Reuters.

Elon Musk takes control of Twitter in $44bn deal

By James Clayton & Peter Hoskins

BBC News 28 October 2022

The world's richest man, Elon Musk, has completed his $44bn (£38.1bn) takeover of Twitter, according to a filing with the US government.

Mr Musk tweeted "the bird is freed" and later said "let the good times roll".

A number of top executives, including the boss, Parag Agrawal, have reportedly been fired. Mr Agrawal and two other executives were escorted out of Twitter's San Francisco headquarters on Thursday evening, said Reuters

Are website names the new real estate?

If you were to buy a house on a nice road, or a shop on a busy street, you can expect to pay a decent premium.

Investors are starting to realise the same goes for domain names.

Domain names like microsoft.com can represent dozens of different IP addresses, but the ownership of such a domain name is the equivalent of owning internet space.

And people will pay a lot for internet real estate, the new Domain Investment Index report from escrow.com has revealed.

Amid the cryptocurrency boom, the domain name of crypto.com sold for a rumoured US$12 million (AU$16.57 million). Ethereum.com is also rumoured to have sold for US$10 million (AU$13.8 million).

“Moreover, aside from domain names’ rate of return and relatively moderate levels of volatility, buying into domain investing can be inexpensive when compared to investment tools such as real estate, which can present a high financial barrier to entry for investors, while attracting additional costs such as land and property taxes,” Escrow.com researchers explained.

“By contrast, ongoing annual maintenance costs for domain names can be in the range of US$10 to 15 per annum.”

While most investors consider domain names an alternative investment that is used largely for capital gains, investors can also lease out the domain names just as physical real estate can be rented out.

And just as the commercial real estate market across the US and Australia has seen increases in prices sought, so too have domain names, with the number of transactions of US$5 million (AU$6.91 million) and above increasing steadily.

However, the domain name market has also experienced volatility in recent years, with some years delivering excellent rates of return and others no or negative returns.

But, argued Escrow.com, domain names have generally delivered more stability than investments in equities or cryptocurrencies.

And as consumers increasingly head online, Escrow.com expects the market will only grow.

“We believe that domain names as an asset class are undervalued. If you buy a shopfront it would cost millions.

“For example, Tiffany’s spends US$20 million (AU$27.62 million) a year renting its fifth avenue shopfront. Yet you can still buy an internet shopfront cheaply,” the analysts concluded.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Now read: Homes in these 20 areas are enjoying the best price growth

Now read: ‘I made $20K on Airtasker’: How seniors are redefining retirement

Now read: AMP appoints Andrea Slattery to its all-male company board

The completion of the deal brings to an end months of legal wrangling but it has prompted questions over the platform's future direction.

A filing was made with the US Securities and Exchange Commission on Thursday, confirming the takeover.

The New York Stock Exchange said on Friday that trading in Twitter's shares had been suspended, giving the reason as "merger effective".

Chief financial officer Ned Segal, and the firm's top legal and policy executive, Vijaya Gadde, are leaving alongside Mr Agrawal, according to US media reports.

Twitter co-founder Biz Stone appeared to confirm the executives' departure. In a tweet, he thanked all three for their "collective contribution to Twitter", calling them "massive talents" and "beautiful humans".

Meanwhile, Bret Taylor - who had served as Twitter's chairman since last November - updated his LinkedIn profile to indicate that he was no longer in the post.

Mr Musk, a self-styled "free speech absolutist", has been critical of Twitter's management and its moderation policies.

They clashed over the terms of the takeover, with Mr Musk accusing Twitter of providing misleading information about the firm's user numbers.

He has also said he would reverse bans on suspended users, which could include former US President Donald Trump, who was excluded following the Capitol riot in January 2021.

At the time, Twitter said there was a risk Mr Trump would incite further violence. But Mr Musk has described the ban as "foolish".

Earlier this week, Mr Musk said that he doesn't want the platform to become an echo chamber for hate and division. "Twitter obviously cannot become a free-for-all hell-scape, where anything can be said with no consequences!" he tweeted.

The takeover has prompted discussion among Twitter users over what the platform will look like under Mr Musk's ownership.

There are fears that more lenient free speech policies would mean people banned for hate speech or disinformation may be invited back to the platform. As well as Mr Trump, that could include political extremists, QAnon loyalists and Covid-19 deniers.

In response to Mr Musk's missive, Thierry Breton the EU commissioner for the internal market tweeted "In Europe, the bird will fly by our EU rules" suggesting regulators will take a tough stance against any relaxation of Twitter's policies.

Mr Musk as well as being the world's richest person with $250bn to his name, is a controversial figure.

He made his fortune through the electric car company Tesla, and space exploration firm Space X. But he has drawn additional attention by his outspoken intervention in unrelated matters, often using Twitter as the platform, ranging from geopolitical issues such as the war in Ukraine to the rescue of the schoolboys trapped in a Thai cave.

Twitter's boss Parag Agrawal is already out, reports say

It is not clear yet whether the clear out of senior management is the forerunner to company-wide job cuts. Earlier reports suggested 75% of staff at the social media company were set to lose their jobs but those reports were "inaccurate", according to Ross Gerber, a shareholder in both Twitter and Mr Musk's other company Tesla.

"There are a lot of talented people at Twitter, especially on the engineering side and they want to retain as much of that talent as possible," Mr Gerber told the BBC.

But he said the job losses could nevertheless extend far beyond upper management. Mr Musk might look to cut product managers and end projects "that aren't going anywhere" he said.

A long road

Until recently it appeared the deal could still fall through.

After building a stake in Twitter at the start of the year, Mr Musk made his $44bn offer in April, a price tag that looked too high almost as soon as it was agreed.

He said he was buying it because he wanted "civilisation to have a common digital town square" and said he planned to clean up spam accounts and preserve the platform as a venue for free speech.

But by the summer he had changed his mind about the purchase, citing concerns that the number of fake accounts on the platform was higher than Twitter claimed.

From South Africa to Silicon Valley - the enigmatic, compelling and controversial inside story of the world's richest man, as told by family, friends and enemies.

But speculation continues around Mr Musk's intentions for the platform.

Change ahead

Earlier this week, he changed his Twitter profile to read "Chief Twit" and some observers believe he will take the reins at the firm himself.

Mr Musk also tweeted a video of himself walking into Twitter's headquarters in San Francisco carrying a sink with the caption: "let that sink in!"

There has been no comment yet from Twitter about its new management team. But whoever becomes its next chief executive, it is clear that Mr Musk will ultimately be in charge of the company - a role he will have to balance with his management positions at both Tesla and SpaceX.

,ELON MUSK

Elon Musk carrying a sink into Twitter HQ

He sat briefly on Twitter's board earlier this year, and criticised the firm's strategy.

In private messages revealed in court filings, Mr Musk talked about how Mr Agrawal didn't understand how to fix the social media platform's problems.

Mr Musk has also posted that his plans for Twitter include more ambitious changes including "X, the app for everything".

Some suggest this might be something along the lines of the hugely successful Chinese app WeChat, a kind of "super app" that incorporates different services including messaging, social media, payments and food orders.

Additional reporting by Lucy Hooker and Chris Vallance

Related topics

Related content

-

What next for Twitter under Elon Musk?

28 October 2022 -

Who is Elon Musk?

28 October 2022 -

Elon Musk: How the world's richest person bought Twitter

28 October 2022

Top Stories

Features & Analysis

-

Eyewitness: 'I was trying to do CPR, but they were both dead'

30 October 2022 -

-

-

-

-

The museum that regenerated a Spanish city

31 October 2022 -

-

Are 15-minute cities the future?

18 August 2022 -

-

-

-

Meet the designers with learning disabilities

29 October 2022 -

Inside US military cyber team’s defence of Ukraine

30 October 2022

Elon Musk: How the world's richest person bought Twitter - BBC News

Elon Musk: How the world's richest person bought Twitter

Image caption,

It was a cool evening in late March in San Jose.

A hastily organised meeting had been arranged at an Airbnb to host the world's richest person.

The meeting was a big one for Twitter. Elon Musk had recently become Twitter's largest shareholder. Now there was talk that he wanted to join the company's board.

When Twitter's chairman, Bret Taylor, arrived at the venue it was not quite what he was expecting.

This "wins for the weirdest place I've had a meeting recently", he reportedly texted Mr Musk.

"I think they were looking for an Airbnb near the airport and there are tractors and donkeys," he told him.

However, the meeting went swimmingly.

A few days later it was announced that Mr Musk was to join Twitter's board.

That was only the beginning. The next six months would witness one of the most crazy, on-off deals in Silicon Valley's history.

At the beginning of April, Mr Musk seemed happy with his board position at Twitter, tweeting regularly about how the company might change.

However, private meetings between him and Twitter's CEO Parag Agrawal had not gone well. The two did not see eye to eye on how to fix the platform. Mr Musk got frustrated.

"Fixing Twitter by chatting with Parag won't work," he is said to have texted Mr Taylor. "Drastic action is needed."

On 14 April, the billionaire publicly stated that he wanted to buy Twitter - lock, stock and barrel.

He offered $44bn (£38bn) for Twitter in a take it or leave it offer. Twitter's board initially rejected the offer, even creating a "poison pill" provision to try to prevent Mr Musk from forcibly buying the company.

Then another change of heart (not the first in this story). Twitter's board decided that, on reflection, they would take the deal and on 25 April, Twitter announced they had accepted the offer.

"Yesssss" Mr Musk tweeted.

Mr Musk argued that Twitter had lost its way. He said Twitter had too often restricted speech and, as the world's "town hall", it needed to place free speech above all else.

He said he did not care about the "economics at all" in an interview at the TED2022 conference in Vancouver, Canada.

That was lucky, because the weeks and months after the deal saw tech stocks fall. Twitter's value also waned. Soon, many analysts began to question whether Mr Musk had overpaid for Twitter.

Publicly, he began to ask a different question - how many real accounts were on Twitter?

The billionaire - ranked by Forbes and Bloomberg as the world's richest person, with a net worth of about $250bn (£216bn) - had for years complained about the number of bots on the platform.

After having his offer accepted, he repeatedly asked Twitter to provide data about how many real users it had.

Twitter executives shared their figure that fewer than 5% of daily active users, based on estimates from randomly sampled accounts, were bots. It appeared to enrage Mr Musk.

After a long Twitter thread from Mr Agrawal, explaining how the company had reached that figure, Mr Musk responded with the poop emoji.

The deal was falling apart. Not entirely unexpectedly, on 8 July, Mr Musk announced he wanted to pull out of the deal.

Was he trying to get a better price for the company or was he genuinely walking away? It was hard to tell.

Twitter was not having any of it. It argued that Mr Musk's agreement to buy the company was legally binding and unpicking the deal now was not an option.

With very expensive lawyers on both sides, a court date was set in Delaware for 17 October to decide whether Mr Musk would be forced to buy the company.

In court documents, Twitter argued it had given him ample information about how many real users it had.

Mr Musk argued Twitter could have many times as many bots than it had publicly claimed, and even accused the company of fraud.

The drip, drip of public criticism was hurting Twitter. The vast majority of Twitter's revenue comes from adverts and advertisers were beginning to wonder how many ads were being shown to real people.

The process was becoming immensely distracting in Twitter HQ too. Some employees relished the idea of Mr Musk becoming their CEO. Many privately - and some publicly - said his purchase would be a disaster for content moderation and the broader goals of the company.

Mr Musk, Twitter, the judge and journalists, were all preparing for what seemed like an inevitable court case when another remarkable twist occurred.

From nowhere, after making all sorts of allegations against Twitter, Mr Musk suddenly announced the deal was back on.

"Buying Twitter is an accelerant to creating X, the everything app," he said.

What had changed his mind? Well perhaps he thought he would lose his court case. A few days before he announced his reversal, he was due to face a deposition by Twitter lawyers. Perhaps he wanted to avoid what would have been a gruelling and likely revealing cross-examination.

Whatever the reason, you can see why Twitter did not pop the champagne corks. Once bitten, twice shy, Twitter reacted, mutedly. Mr Taylor tweeted that the company was "committed to closing the transaction on the price and terms agreed upon with Mr Musk".

Twitter also asked for the court case to be postponed, not cancelled. Mr Musk's lawyers retorted that Twitter "won't take yes for an answer".

Mr Musk had until 17:00 BST on 28 October to come up with the money.

Billions would be stumped up by his rich friends and banks. The rest of it, from Mr Musk, by selling some of his shares in Tesla.

A deal which at times looked intractably, impossibly broken, now appears to have finally been concluded.

James Clayton is the BBC's North America technology reporter based in San Francisco. Follow him on Twitter @jamesclayton5.

-

No change to Twitter moderation policy yet - Musk

-

2 days ago

-

-

Elon Musk takes control of Twitter in $44bn deal

-

2 days ago

-

-

Musk Twitter deal back on in surprise U-turn

-

4 October

-

-

Why did Musk get cold feet on Twitter?

-

9 July

-

-

Elon Musk subpoenas Twitter founder in court battle

-

22 August

-

Yahoo! Inc., which is 90% owned by investment funds managed by Apollo Global Management and 10% by Verizon Communications

Yahoo! Inc.,provides a web portal, search engine Yahoo Search, and related services, including My Yahoo!, Yahoo Mail, Yahoo News, Yahoo Finance, Yahoo Sports and its advertising platform, Yahoo! Native.

Yahoo was established by Jerry Yang and David Filo in January 1994 and was one of the pioneers of the early Internet era in the 1990s.[6] However, usage declined in the late 2000s as some services discontinued and it lost market share to Facebook and Google.[7][8]

-

-

-

Yahoo! (/ˈjɑːhuː/, styled yahoo! in its logo)[4][5] is an American web services provider. It is headquartered in Sunnyvale, California and operated by the namesake company Yahoo Inc., which is 90% owned by investment funds managed by Apollo Global Management and 10% by Verizon Communications.

-

https://finance.yahoo.com/

news/remember-yahoo-turned- down-1-132805083.html -

Yahoo! Inc. (NASDAQ: YHOO) confirmed on Monday it reached an agreement to sell its Internet properties to Verizon Communications Inc. (NYSE: VZ) for $4.83 billion.

Taking a look back at Yahoo's M&A opportunities, the going price for Yahoo's assets today could have been in the hundreds of billions of dollars.

Related Link: Verizon To Acquire Yahoo's Operating Business For .8 Billion

Back in 1998, two individuals, Larry Page and Sergei Brin, who were unknown to the technology company offered to sell their little startup to AltaVista for $1 million so they can resume their studies at Stanford.

The company that Page and Brin were looking to sell was the soon-to-be patented PageRank system and represents the core of Google (Alphabet Inc (NASDAQ: GOOG) (NASDAQ: GOOGL))'s existence.

-

AltaVista turned down the offer to acquire the company. Similarly, Yahoo wanted its users to spend more time on its own platform, contrasting PageRank, which sends a user to the most relevant web site.

Yahoo had another opportunity to acquire Google. In 2002, Yahoo's CEO at the time, Terry Semel, engaged in negotiations to acquire Google, which lasted several months.

The outcome of the negotiation was Semel balking at Google's price tag of $5 billion.

Today, Google and its parent company Alphabet boast a market capitalization of more than $500 billion.

$40 Billion Still A Better Offer

Microsoft Corporation (NASDAQ: MSFT) proposed to acquire Yahoo's entire business in 2008 for $44.6 billion, or $31 per share.

The price tag on a deal represented a premium of 62 percent above Yahoo's closing price the day before Microsoft went public with its offer.

Microsoft said that a joint Microsoft-Yahoo entity can dominate the online advertising market and create a more efficient company and generate at least $1 billion in annual synergies.

"We have great respect for Yahoo!, and together we can offer an increasingly exciting set of solutions for consumers, publishers and advertisers while becoming better positioned to compete in the online services market," said Steve Ballmer, chief executive officer of Microsoft. "We believe our combination will deliver superior value to our respective shareholders and better choice and innovation to our customers and industry partners."

Did you like this article? Could it have been improved? Please email This email address is being protected from spambots. You need JavaScript enabled to view it. with the story link to let us know!

See more from Benzinga

-

https://finance.yahoo.com/

news/remember-yahoo-turned- down-1-132805083.html -

Remember When Yahoo Turned Down $1 Million To Buy Google?

Jayson Derrick July 25, 2016Staking a claim on domains beyond dot-comIn the $1 billion market for Web addresses, country-specific domain names are the latest sector to heat up.By Paul Sloan, Business 2.0 Magazine editor-at-largeAugust 29 2006: 10:45 AM EDT

SAN FRANCISCO (Business 2.0) -- Real estate prices might be falling in some areas - but that's for physical real estate. Virtual real estate, in the form of Internet domain names - the part after the "www" in a website's address - is on a tear and showing no signs of slowing down.

By some estimates, the market for registering and trading domain names could reach $2.5 billion this year.

By some estimates, the market for registering and trading domain names could reach $2.5 billion this year.

And in the latest twist, domain investors have been bidding up prices of domain names around the world. The dot-com ending - ".com" - is still the Rodeo Drive of the Web, but as Internet usage spreads around the globe, the demand for suffixes like .eu (European Union), .es (Spain), .cn (China) and .br (Brazil) is heating up, too.

What makes domain names so valuable is the boom in Internet advertising. Part of the appeal of generic, easy-to-remember names is that people often search the Web by typing website addresses directly into browsers, a phenomenon that's referred to as direct navigation. Site owners then turn that traffic into cash by filling their sites with relevant ads provided by Google (Charts), Yahoo (Cha

rts), and other online-advertising networks. Diversifying in Internet real estateTim Schumacher, CEO of domain-name trading website Sedo, says that, like stock investors, domain investors are looking to diversify. And one way to do that is to invest in non-dot-com domains from elsewhere in the world. Several American-based registrars are offering ways to buy domains from other countries, but of course it takes some research to figure out which ones might make sense to gamble on.

Schumacher argues that the trend is just beginning, and in many countries the market has huge potential. A key reason is that in many parts of the world, dot-com is not the preferred domain suffix. In Germany, for instance, companies advertise their .de Web addresses more prominently than their .com addresses. "It's really a local thing," he says.

Current hot markets, according to Schumacher, include .mx (Mexico) and .pl (Poland). In some countries, he says, "These addresses will rival dot.coms."

An overseas Internet gold rushEven with Google and Yahoo's best efforts, the Internet advertising revolution is still in its early stages, especially overseas. But if they're successful at bringing online ads to more countries, overseas domain owners are going to find themselves sitting on prime property.

"As people in many regions go online, these names will become great pieces of real estate," says Marc Ostrofsky, president of iReit, a private company that is accumulating domain names and is backed in part by Starbucks (Charts) founder Howard Schultz. In the past year and a half, iReit has amassed a domain portfolio of more than 400,000 names.

This spring it spent millions of dollars - Ostrofsky describes the amount as "mid-seven figures" - to buy up a collection of names ending in .de (Germany), .nl (the Netherlands) and .fr (France). The firm is now looking into deals in India and China.

Dot-coms tapped out?One explanation for the offshore-domain gold rush is pretty straightforward: Try to register almost any dot-com name, whether an acronym, a compound word, or even a common typo, and you'll find it's gone. Snagging one requires paying big bucks to an individual holder or bidding in one of the many after-market domain name auctions that go on at sites like Sedo and SnapNames.com.

Some recent sales have been eye-popping: Diamond.com sold for $7.5 million. Even misspelled words are commanding a high price: morgage.com (that's right, without the "t") fetched $242,400.

"The dot-com [suffix] is so saturated that if you want a strong keyword or an acronym you're not going to get it without paying six figures," said Ron Jackson, editor and publisher of DN Journal, the domain industry's online trade journal. "That's why a variety of extensions are breaking out like crazy this year."

Those suffixes, or "extensions," as they're known in the industry, are still far cheaper than the dot-coms, but the market's growth is impressive. Even United States's .us geographic extension, which carries nowhere the near the cachet of .com, has seen some surprising transactions, such a sale this month on Sedo of Hangover.us for $9,500.

There are other reasons for the non-dot-com boom. Some regional extensions are only just opening up for business, which can create a stampede of speculators. In April, the 25-nation European Union finally launched the .eu extension, and the rush to snap them up made for the biggest out-of-the-gate domain offering ever. The suffix quickly became the Web's eighth most popular.

The .eu launch has been tainted by controversy, however, with accusations that domain speculators set up phantom companies to snag the best names. But the aftermarket already has enriched some: In July, Hotels.eu sold for $330,000, according to Sedo, and Shopping.eu fetched $200,000.

They may not be fetching the multimillion-dollar price tags that a good dot-com can get. But if the big money investing in domain names has this trend right, this is just the start of a boom in overseas Web addresses.

Related:

Elon Musk, with his bombastic tweets, is filling the void vacated by Trump on Twitter

Analysis by Oliver Darcy, CNN BusinessUpdated 5:29 AM EDT, Tue November 1, 2022New YorkCNN Business —Elon Musk has filled the void vacated by Donald Trump on Twitter, mirroring the former president’s behavior on the platform through his promotion of misinformation, attacks on news organizations, and desire to rule by tweet.

Take Musk’s last 24 hours on the platform for example: The billionaire gave credence to a fringe conspiracy theory about the brutal attack on Paul Pelosi. Then, when media outlets reported on his irresponsible behavior, Musk assailed them. He trolled The New York Times in one tweet and chastised The Guardian as a “far left wing propaganda machine” in another.

All the while, Musk has showed a desire to rule Twitter as an institution by tweet. Like Trump, Musk has eschewed the traditional, more formal style of corporate governance used by his predecessors. In fact, he’s blown that model up. Twitter has yet to issue one formal press release (that I’m aware of) since Musk took over, but the platform has made plenty of news.

Instead of communicating through conventional means, Musk has chosen to make significant news through seemingly off-the-cuff tweets — just like Trump. For example, Musk disclosed that “the whole verification process is being revamped” in a random reply message to a photographer. Normally, such an announcement would be rolled out in a highly choreographed manner.

The worry about Musk’s behavior, however, is not about how he announces changes to the platform. It’s about the recklessness in the way he operates.

Twitter is an important communications platform that plays an outsized role in our information environment — and it is one that the billionaire now unilaterally controls. As the steward of the platform, Musk has an implicit responsibility to make sure that it doesn’t become, as he put it, a “hellscape.”

But since he ascended to “Chief Twit,” Musk’s actions have suggested he simply does not care about it.

In fact, not only has Musk himself contaminated the information environment he now reigns over, but he is apparently working to dismantle the little infrastructure erected to help users sift through the daily chaos. Recent news reports, including from CNN, indicate that he plans to strip public figures and institutions of their blue verified badges if they do not pay.

Charging for verified badges might appear at first glance as a business story. But the move will have significant ramifications on the information landscape. Most notably, it will make it much more difficult for users to distinguish from authentic and inauthentic accounts.

Perhaps, however, that is the point.

The right has for years lashed out at “blue checks,” whom in their eyes represent elitist gatekeepers who control the conversation, even though many conservatives also don blue badges. Taking away those free blue checks, and the air of authority they give upon the profile they are appended to, will certainly delight some conservatives.

Musk’s authorized biographer, Walter Isaacson, tweeted in 2018 that “the best thing” one could do to “save social networks, the internet, civil discourse, democracy, email, and reduce hacking would be authenticating users.”

Now, nearly five years after his tweet, Musk is moving to do the opposite for users who refuse to pay. It says a lot about how he is running Twitter.

Kohl's receives $2 billion real estate bid from Oak Street

Yahoo Finance Live looks at Kohl's stock after the retailer received a bid on its stores' real estate.

Video Transcript

[AUDIO LOGO]

SEANA SMITH: All right, my play today, a lot more boring than that, it's Kohl's. It's a top trending ticker, though, on Yahoo Finance. Shares jumping today, up just around 5% off the highs of the day on reports of a $2 billion offer for its real estate. Now, according to Reuters, PE firm Oak Street Real Estate is interested in their properties. And the retailer will then potentially leaseback its stores. It's not clear how many of Kohl's 1,100 stores will be involved in this agreement.

Dave, this could give goals-- Kohl's another chance here to reach a deal after talks to sell itself to Franchise Group fell through earlier this summer. We know that Kohl's is far from the only one in the retail space that has been struggling as of late. Lots of questions here from investors, just in terms of the company's turnaround strategy, what that looks like going forward. Whether or not this actually goes through, it could potentially be a good option here for Kohl's.

DAVE BRIGGS: Not great option but good. Yeah, I mean, that initial deal from Franchise Group, which owns Vitamin Shoppe, was $8 billion. And so watching that disintegrate probably feels very painful on this day. Some of their plans involved-- they talked about some unused inventory that they're going to put back on the shelves in 2023, hoping that either styles don't change or consumers don't notice. It feels desperate.

We've talked about this with Bed Bath & Beyond. A massive real estate play it will eventually be if, in fact, they file for Chapter 11. You're talking about 900 stores for Bed Bath & Beyond. Enormous footprints. If those two go away, the commercial landscape across this country looks very different.