War Tax Resistance Resources National War Tax Resistance Coordinating Committe

WarTaxResistanceResourcesNationalWarTaxResistanceCoordinatingCommitte

"War Tax Resistance Resources - National War Tax Resistance Coordinating Committee"

If you work for peace, stop paying for war.

https://nwtrcc.org/war-tax-

National War Tax Resistance Coordinating Committee (NWTRCC)

P.O. Box 5616, Milwaukee, WI 53205

• (262) 399-8217 • (800) 269-7464

National Affiliates:

Community Peacemaker Teams,

Center on Conscience & War,

Episcopal Peace Fellowship,

Fellowship of Reconciliation,

Mennonite Central Committee,

National Campaign for a Peace Tax Fund,

Nonviolence International, Sojourners, War Resisters League, War Tax Resisters Penalty Fund

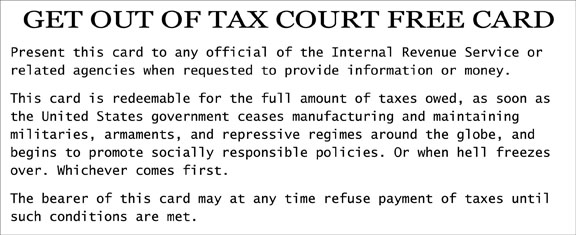

War Tax Resistance Resources

NWTRCC produces a variety of tools and resources to support individuals who refuse to pay for war or are considering this form of war resistance. As a network of organizers and organizations, NWTRCC also produces resources for groups and individuals to use in outreach and organizing.

Many of our materials can be read online or downloaded from our website. Some are available for purchase through our Store, and bulk rates are available if you are using them for groups or outreach. Please use our materials with your local contact stamp and help us expand outreach about war tax resistance. And please contact us if you have ideas for new materials.

Under this Resource section you will find:

⇒ Practical Series Booklets and Basic Brochures (free PDF downloads)

⇒ Flyers Free downloads for specific occasions or general information.

⇒ Books A reading list of books about war tax resistance or by war tax resisters. Ordering information is listed where available.

⇒ Readings Various and sundry essays, writings and links to other blog and pages related to war tax resistance.

⇒ Links To groups working on war tax resistance or peace tax campaigns in the U.S. and beyond, and other peace and justice groups.

⇒ Video Our introductory 30-minute film Death and Taxes. Order a DVD or watch online.

⇒ History Decades of history about refusal to pay war taxes, starting with Lysistrata in 411 B.C.E.

⇒ Speakers’ Bureau Invite a war tax resister to come to your group for a workshop or talk.

National War Tax Resistance Coordinating Committee (NWTRCC) P.O. Box 5616, Milwaukee, WI 53205 • (262) 399-8217 • (800) 269-7464

National Affiliates:

Community Peacemaker Teams,

Center on Conscience & War, Episcopal Peace Fellowship,

Fellowship of Reconciliation,

Mennonite Central Committee,

National Campaign for a Peace Tax Fund,

Nonviolence International,

Sojourners,

War Resisters League,

War Tax Resisters Penalty Fund

Resources

The Streets of New York, The Letter in the Mailbox

Recent Posts

- The Streets of New York, The Letter in the Mailbox April 18, 2024

- My Letter to the IRS April 11, 2024

- Busting through the Bottom Line March 15, 2024

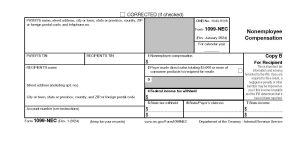

- Resisting War Taxes in the Gig Economy March 7, 2024

- Tax Day 2024- Here we Come! February 29, 2024

Tax Resistance - body on the line | a guide to putting your body where your mouth is

body on the line

a guide to putting your body where your mouth is

Tax resistance

To Whom It May Concern at the IRS:

I have decided to stop paying my US taxes because I’m fed up with watching the federal government spend trillions of dollars on the destruction of human beings across the planet. This has been going on far too long and I refuse to spend a single cent on the genocide of the Palestinian people.

Rather than waste my time filing out my tax forms I’m sending the exact amount that I was required to pay last year – $2,168 – to two charities of my choice because I know the money will be better spent in their hands than in yours.

The first half has been sent to Middle East Children’s Alliance and the second half has been sent to UNRWA.

I know that there are many things Americans could benefit from with tax money – from healthcare to education – but in spite of millions of Americans putting money into the pot every year, you continue to squander the funds on the military industrial complex. You have shown yourself to be irresponsible when it comes to managing and budgeting your (really our) money.

I’m grateful to the National War Tax Resistance Coordinating Committee for their incredibly helpful webinars and resources that showed me various ways of resisting taxes. If you are curious and want to get started check out their YouTube channel. Also, Al Jazeera’s “The Take” podcast this week covers tax resistance in the US.

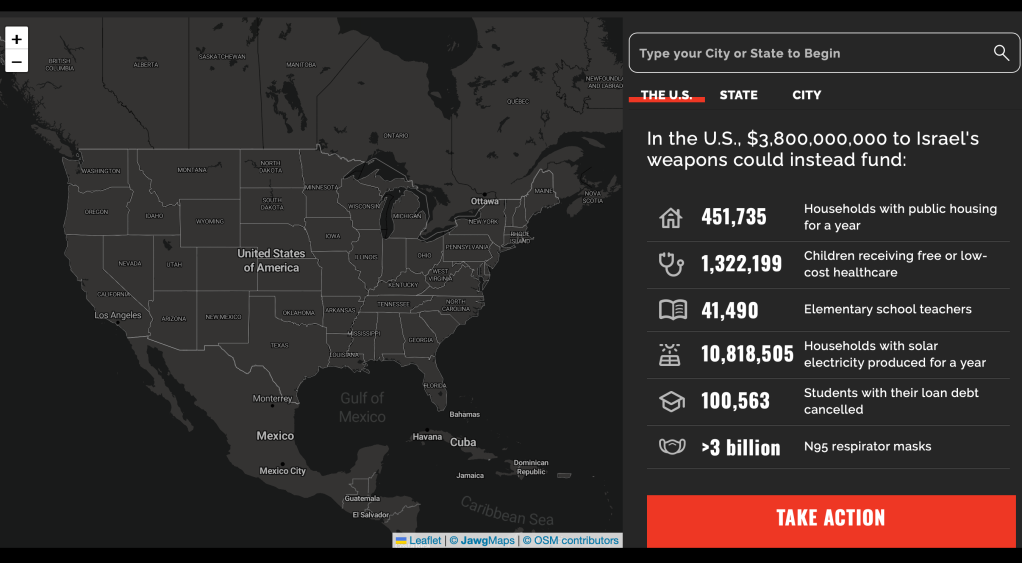

You can see where it did go and where it could have gone.

Also the National Priorities Project will show you even more specifically which private contractors your tax dollars are going to fund within the military industrial complex:

If you put in the figure of federal taxes paid, they will issue you a tax receipt showing where your money has gone. Here is where mine would be going had I paid my taxes:

You can use these websites to declare a specific amount of your taxes that you want to offset for Gaza as well.

And below please find and share these wonderful visuals from Visualizing Palestine to promote USPCR’s Not My Tax Dollars campaign.

An International History of War Tax Resistance - National War Tax Resistance Coordinating Committee

https://nwtrcc.org/war-tax-

If you work for peace, stop paying for war.

An International History of War Tax Resistance

From 400 B.C. to 2000 A.D.

Where there’s war, you’ll find war tax resisters.

The information presented on these web pages was originally part of a six poster set that NWTRCC sold for display. The posters are out-of-print, so we’ve transferred the information from the posters to this website and continue to insert new items and correct any errors.

The exhibit was originally researched and published by members of Pioneer Valley War Tax Resistance in western Massachusetts, with credit going to Juanita Nelson, Steve Snow-Cobb and Ginny S. Much of the original material is from War Tax Resistance: A Guide to Withholding Your Support from the Military, written by Ed Hedemann and published by the War Resisters League. NWTRCC also sells the book, which includes a 2010 update.

Thanks to volunteer typist and researcher Jonathan Stubbs for helping to transfer the information from the printed posters to the internet.

Please browse through these pages. We welcome your additions, updates, and questions.

400 B.C.E. to 1699 C.E. - National War Tax Resistance Coordinating Committee

"400 B.C.E. to 1699 C.E. - National War Tax Resistance Coordinating Committee"

400 B.C.E. to 1699 C.E.

411 B.C.E.: Lysistrata Was a Right-On Woman

If you work for peace, stop paying for war.

In Aristophanes’ play, Lysistrata, Greek women refused to have sex with their war-mongering husbands until they agreed to stop fighting, and they provided an early example of war tax resistance.

Magistrate: What in Zeus’ name do you mean by shutting and barring the gates of our own Acropolis against us?

Lysistrata: We want to keep the money safe and stop you from waging war.

Magistrate: The war has nothing to do with money.

Lysistrata: Hasn’t it? Why are Peisander and the other office seekers always stirring things up? Isn’t it so they can take a few more dips in the public purse? Well, as far as we are concerned, they can do what they like; only they’re not going to lay their hands on the money in there.

Magistrate: Why, what are you going to do?

Lysistrata: Do? Why, we’ll be in charge of it.

Magistrate: You in charge of our finances?

Lysistrata: Well, what’s so strange about that? We’ve been in charge of you’re your house keeping finances for years.

Magistrate: But that’s not the same thing.

Lysistrata: Why not?

Magistrate: Because the money purse is needed for the war!

Lysistrata: Ah, but the war itself isn’t necessary.

—From Aristophanes, Lysistrata (411 B.C.), translated by Alan H. Sommerstein, Penguin Classics, reprinted in the Peace Tax Campaign Newsletter from Great Britain.

200 B.C.E.: Egypt

Collective tax refusal was reported in Egypt.

1197 C.E.: St. Hugh of Lincoln St.

Hugh refused to pay a tax to fund Richard the Lionhearted’s war against the King of France. All his property was seized.

1500s: Dutch Wars

Many people refused to pay a special war tax imposed on the Dutch to finance the wars of Philip II, King of Spain and Duke of Holland.

1515: Danish Taxes

Norwegian peasants refused to pay tax increases levied by the Danish king to support his war against Sweden. They killed the tax collectors.

1630s: Norway

There was a widespread movement against paying taxes in Norway.

1637: Native Americans

Algonquins opposed taxation by the Dutch to improve a local Dutch fort.

Mid-1600s: Humanists

A group of humanists in the Netherlands refused to pay taxes due to their opposition to violence.

1672: Quakers in America

Quakers refused tax payments for the repair of fortifications in New York at the beginning of the Anglo-Dutch War.

1689: Pennsylvania Colony

The Quaker Assembly in charge of the Pennsylvania Colony was resistant to appeals for funds to aid in King William’s War.

1700s

1709: Refusing to Hire to Kill

The Quaker Assembly refused a request of 4,000 pounds for an expedition into Canada, replying it was contrary to their religious principles to hire men to kill one another.

1755: John Woolman Objects to Mixed Taxes

John Woolman and other Quakers tried unsuccessfully to persuade the Society of Friends to refuse payment of 60,000 pounds in tax levied by the Pennsylvania Colony for war purposes. This may be the first group effort among Quakers against the collection of “mixed taxes,” or military taxes that are collected into a multi-purpose fund. They were joined by some Dunkards (Brethren) and Mennonites.

1764–5: Norwegian Tax Rebellion Leads to Change

A major tax rebellion to protest high taxes and corruption occurred in Norway and resulted in a reduction in tax assessments by one half.

1775–1783: American Revolution

Most Quakers were opposed to military taxes during the American Revolution. The official position of the Society of Friends supported this position. Many Quakers were jailed, and some had property seized and auctioned. Up to 500 Quakers were disowned for paying war taxes or joining the army. Some Quakers pledged tax resistance after the war in opposition to war preparation and the war debt.

1789: French Revolution

During the French Revolution, the National Assembly encouraged refusal to pay all past taxes to the king.

1798: Irish Rebellion

Quakers refused to pay military taxes during the Irish Rebellion.

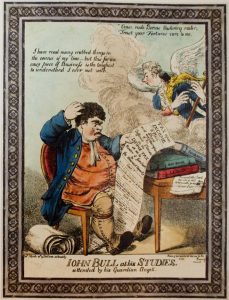

1798: Income Tax Introduced into Britain

In what is considered the inception of the modern income tax, British Prime Minister William Pitt the Younger established the first — and most unpopular — income tax in Britain in December 1798 to pay for his war with France.

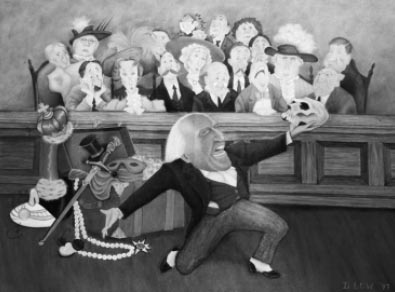

The cartoon shows British Prime Minister William Pitt the Younger (represented by a harp-playing angel) trying to trick the English public (represented by John Bull, the personification of England) to pay for the war through an income tax.

The 1800s

1812–15: War of 1812

https://nwtrcc.org/war-tax-resistance-resources/international-history-of-war-tax-resistance/1800s/

During the War of 1812, massive tax resistance was threatened by Federalists, ship owners, and bankers, who thought the issues were not important enough to go to war.

1820: Russia

Russia became the first country to establish legislation exempting pacifists from paying war taxes. Czar Alexander I issued a certificate of military tax exemption for Quakers.

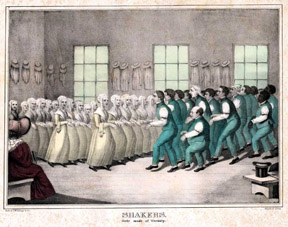

1838: Resisters Include Abolitionists and Shakers

The New England Non-Resistance Society was founded in Boston at a special peace convention organized by William Lloyd Garrison, and favored war tax resistance. The Shakers in New Hampshire pledged to resist taxes for war no matter what the consequences.

1846–48: Mexican-American War

During the Mexican War, the Quakers refused to pay war taxes particularly because of the war’s aggressiveness and the threatened spread of slavery.

1846: Thoreau’s Civil Disobedience

From 1841 to 1848 (except for 1843 when he was out of state), Henry David Thoreau refused to pay the annual $1.50 ($36 in 2010 dollars) Massachusetts poll tax because of his disgust for slavery and then the Mexican-American War (1846-1848). His July 1846 arrest and the night he spent in jail was recorded in his essay, “On the Duty of Civil Disobedience.” Thoreau’s action was aimed more at social change than personal removal from the war efforts. Against his wishes, aunt Maria paid the tax the next morning, which resulted in his release, according to Sam Staples, the tax collector and Thoreau’s jailer (interviewed by Samuel Arthur Jones, The Islander, Ann-Arbor, MI, 1898).

1861: Hungary

Hundreds of Hungarians stopped paying taxes to the Austrian Emperor, Franz Joseph I, who needed more money to fight Napoleon III. When property was seized for the unpaid taxes, auctioneers refused to auction it. When Austrian auctioneers were brought in, Hungarians refused to bid. It cost more to collect than what was collected.

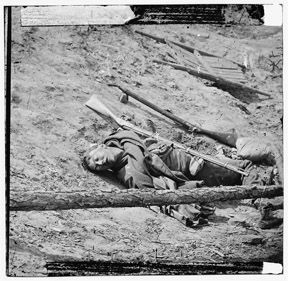

1861–65: The American Civil War

During the Civil War, many who had previously refused taxes decided that paying war taxes supported freeing slaves rather than killing people. Some Quakers continued to resist war taxes. The Society of Friends (Quakers) continued to support non-payment although they were more tolerant of those who paid than before.

1866: Universal Peace Union (UPU)

After the Civil War, the Universal Peace Union (UPU) was formed. Aroused by the horror of what the war had done to the country, the UPU called for immediate disarmament, denounced imperialism, and urged a boycott of war taxes. A number of its members were jailed or had property seized. Belva Ann Lockwood (photo) was the first woman to run for president of the United States and a leader of the UPU.

1900-1959

1917–1919: World War I

During World War I, some members of the Quakers, Brethren, and Mennonites and a few political activists resisted War Bonds and Liberty Loans.

If you work for peace, stop paying for war.

“Being a pacifist between wars is as easy as

being a vegetarian between meals.”

–Ammon Hennacy

Ammon Hennacy (pictured in 1923 passport photo) was imprisoned for two years for refusing to register for the World War I draft, a stand that he repeated at the onset of the second World War. In prison he became a Christian anarchist and pacifist. Hennacy never paid any taxes in his life because of their use in paying for the military and war, and he reduced his tax liability by living in voluntary poverty. He spent years waging peace and teaching that the absence of war is not peace in a country that puts half its tax collections into guns, bombs and the practice of killing.

1930: Salt Campaign in India

The Indian campaign for independence from Britain involved a number of instances of mass tax resistance, including this 24-day, 241-mile march to the coastline to make salt illegally. Thus, M.K. Gandhi began a boycott of the salt laws by millions throughout India.

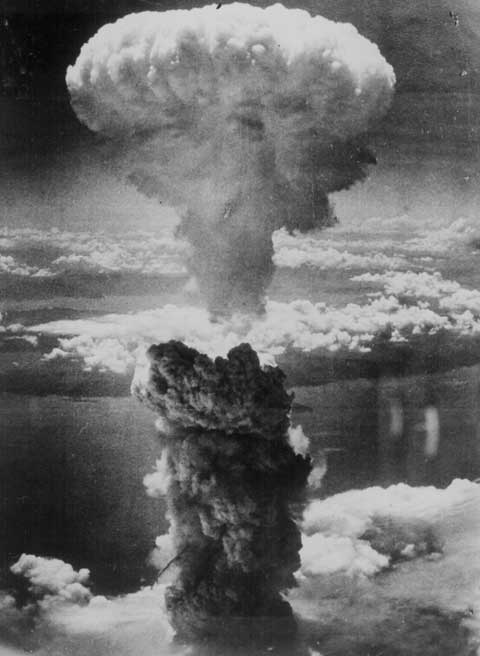

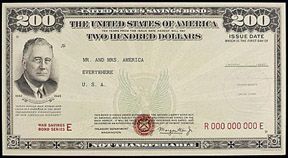

1941–1945: World War II

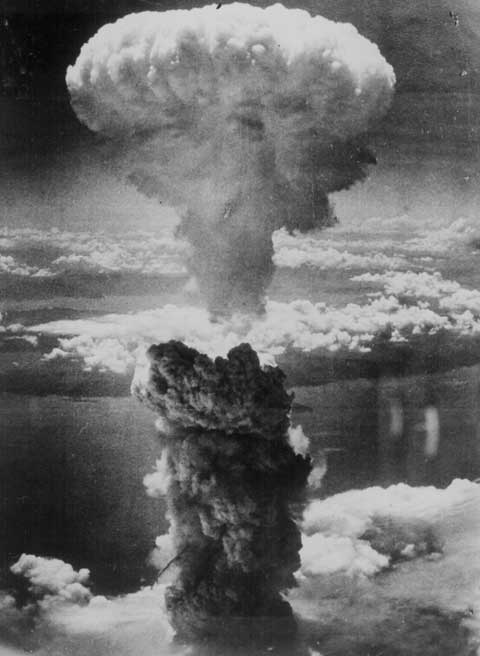

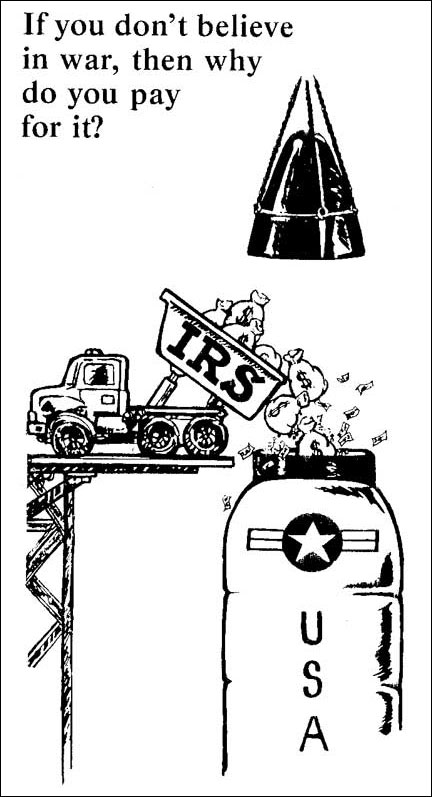

With the imposition of federal income tax withholding in 1943 and the 1945 bombings of Hiroshima and Nagasaki, World War II stirred the troubled waters from which the modern war tax movement emerged.

Until World War II, individual income tax was a minor part of the federal government receipts. Income tax returns had a 10% “Defense Tax” added as a result of a Revenue Act of 1940. In 1941, a number of organizations, including Women’s International League for Peace and Freedom and American Friends Service Committee (AFSC), protested.

The 1942 Irving Berlin song sung by Gene Autrey “I Paid My Income Tax Today” promoted payment of taxes for war: “See those bombers in the sky? / Rockefeller helped to build ’em, so did I / I paid my income tax today … A thousand planes to bomb Berlin / They’ll all be paid for and I chipped in.”

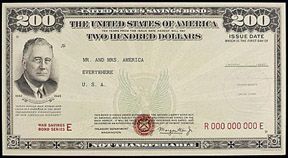

The federal government agreed to authorize AFSC to issue Civilian Public Service Bonds and Stamps as an alternative to Victory Bonds and Stamps.

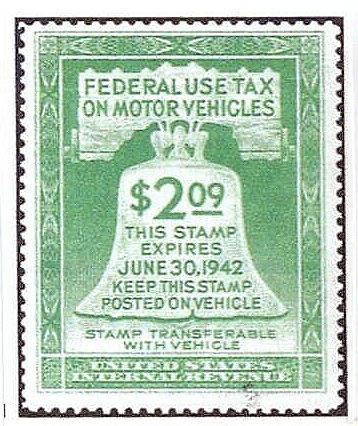

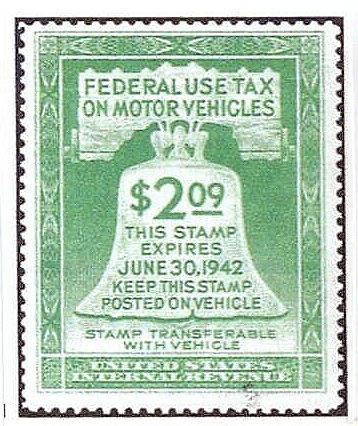

In 1942, Ernest Bromley, Bath, N.C., refused payment of $2.09 and $5 for defense tax stamps required for all U.S.cars. He was arrested and jailed for 60 days. So many cars were driven without the stamps that the law was declared unenforceable and was dropped in 1944.

Then in 1943, payroll withholding was instituted, compelling employers to withhold federal income taxes from workers’ paychecks and pay them to the government, suddenly conscripting the taxes of a huge number of Americans — from 8 to 60 million over a period of six years — into the war effort.

Other war tax resisters during the war and shortly afterwards included Max Sandin (also an imprisoned World War I resister), Walter Gormly, A.J. Muste, Dave Dellinger, James Otsuka, Marion Bromley, Marj Swann, Wally Nelson, Juanita Nelson, Ralph Templin,Milton Mayer, Maurice McCrackin, Fyke Farmer, and Lawrence Scott.

See: Pioneers of the Modern American War Tax Resistance Movement.

1946: New Zealand Resister Jailed

Raymond E. Hansen, Beeville Community, North Island, N.Z., was jailed in 1946 and 1947 for refusal to pay taxes used directly for militarization. In 1949, despite his refusal to pay a £100 fine and £12 in court costs, he was not jailed again.

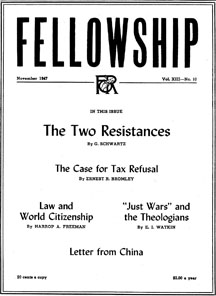

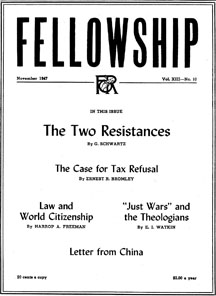

1947: Fellowship Magazine

The first article on war tax resistance — “The Case for Tax Refusal” by Ernest Bromley — appeared in Fellowship magazine, published by the Fellowship of Reconciliation.

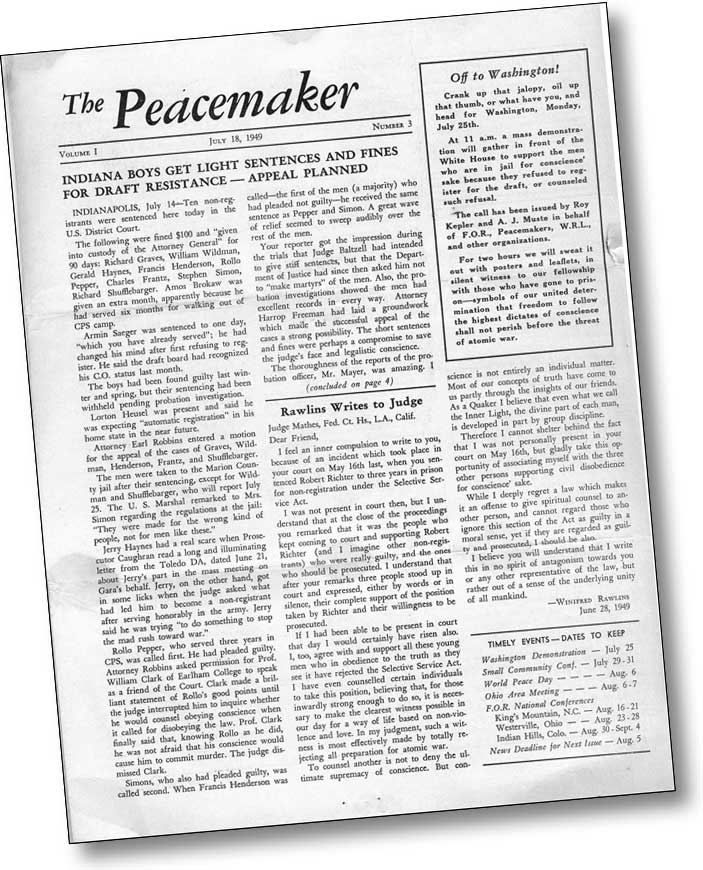

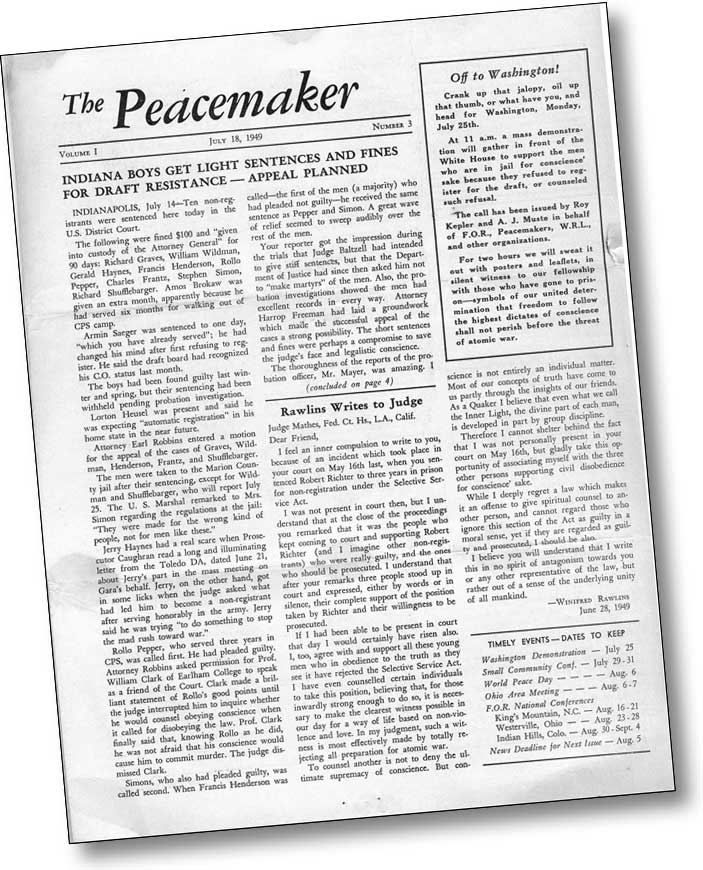

1948: Peacemakers

A conference on “More Disciplined and Revolutionary Pacifist Activity” was held in Chicago. Peacemakers, the first organization to promote war tax resistance, grew out of the conference. The organization published “News of Tax Refusal” (1949–1952) and The Peacemaker (1949–1992) on war tax resistance.

Two approaches to war tax resistance emerged at this time: one was to earn so little money that no taxes were owed, and the other was to refuse to pay all or part of their taxes on the grounds that a large portion supported the war effort.

Wally Nelson, Juanita Nelson, Ernest Bromley, Marion Bromley, Maurice

McCrackin. Photo: Ed Hedemann.

1949: Contempt of Court

James Otsuka, Richmond, Ind., a World War II draft resister, was the first of only two people in modern times jailed for refusal to pay war taxes ($4.50) as well as contempt of court for refusal to turn over records to the IRS. He was sentenced to 3 months and $100 fine but spent 4 and a half months in jail, finally released on Jan. 16, 1950.

1951: First Telephone Tax Refuser Protests Korean War

Franklin Zahn (pictured here in 1959) became the first telephone war tax resister by refusing the 15% federal tax during the Korean War. When the refused tax reached $1.59, Bell Telephone disconnected his telephone service. Zahn continued refusal until the end of war in 1953, then resumed his refusal during the Vietnam War.

1951: First Car Seized

In 1951, Walter Gormly, Mt. Vernon, Iowa, was the first person to have a car seized and auctioned by the IRS for nonpayment of war taxes.

1957: First House Seized

In 1957, Raymond and Jean Olds, Yellow Springs, Ohio, were the first people in modern times to have their house seized by the IRS for nonpayment of war taxes ($160). They also had a truck seized the same year.

1958: Noncooperation

Another Peacemaker, Cincinnati Presbyterian minister Maurice McCrackin, spent six months in jail for refusing to turn over his financial records to the IRS and noncooperating with court proceedings. He was released in May 1959. His response pioneered the art of complete non-cooperation.

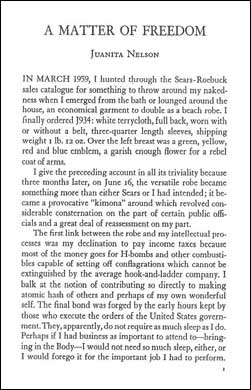

1959: Jailed for War Tax Resistance

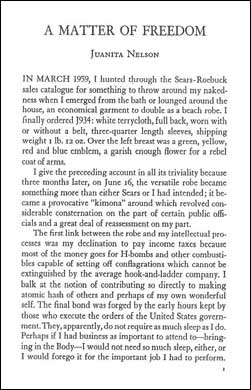

Juanita Nelson was the first U.S. woman jailed for war tax resistance. She was released the same day as the arrest. The IRS never collected any money. The story of her arrest, “A Matter of Freedom,” was published in Liberation magazine.

A MATTER OF FREEDOM BY JUANITA NELSON

In March 1959, I hunter through the Scars-Rocbuck sales catalogue for something to thrown around my nakedness when I emerged from the bath or lounged around the house, an economical garment to double as a beach robe. I finally ordered I934; white terrycloth, full back, worn with or without a belt, three quarter length, shipping weight 1 lb. 12 oz. Over the left breast was a green, yellow, ref and blue emblem, a garish enough flower for a rebel coat of arms .....

1960s

1960: Noncooperating Resister

https://nwtrcc.org/war-tax-resistance-resources/international-history-of-war-tax-resistance/1960s/

Amateur athlete and war tax resister Eroseanna Robinson, Chicago, Ill., refused to turn over records to the IRS and was sentenced to 12 months for contempt after a high-profile court case. However, her total refusal to cooperate and a persistent hunger strike forced authorities to release her on Mar. 1, 1960, from Alderson, W.V., after serving only three months. The photo (left) shows Robinson being taken to U.S. District Court on a stretcher because of her refusal to walk.

1960: London Tax Refusal Committee

The Committee Against Tax for Nuclear Arms was established in London, which urged self-employed people to refuse payment of income taxes. (The Peacemaker, Nov. 5, 1960)

1961: Sit-in at IRS Headquarters

Sentenced to be shot for refusing to go into the military during the first World War, Max Sandin, a war tax resister since 1942, staged a sit-in at the Treasury Dept. in Washington, DC, on Aug. 29, to protest the IRS seizure of his social security checks. He was arrested and taken to the hospital for a “sanity test,” which he passed and was eventually released after 13 days. Nevertheless, the IRS continued to seize his social security and painters’ union pension checks.

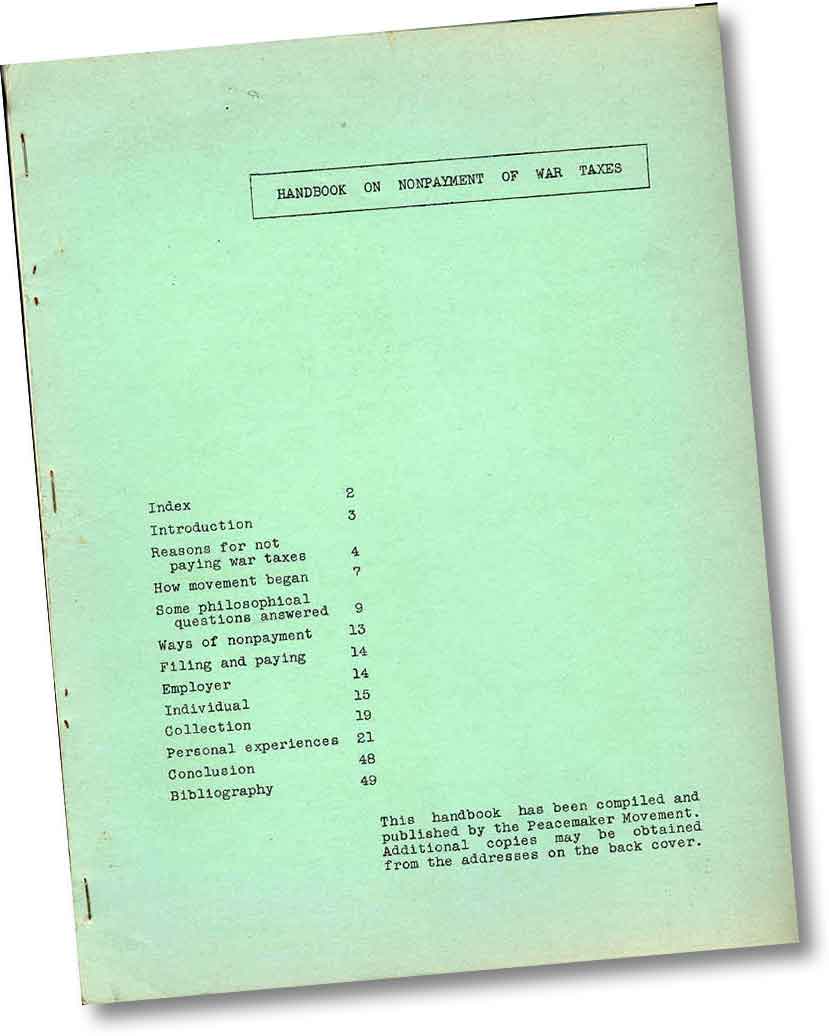

1963: First Book on War Tax Refusal

The first war tax refusal book, Handbook on Nonpayment of War Taxes, was published by the Peacemakers in 1963. Its fourth and last edition was published in 1991.

Maurice McCrackin was removed from the ministry of the United Presbyterian Church for his refusal to pay war taxes.

Denver physician and war tax resister Arthur Evans was sentenced to and served 3 months in Jefferson County Jail for refusing to turn over financial records to the IRS.

1964: Singer Resists Income Tax for Vietnam War

In April 1964, folk singer Joan Baez announced her refusal to pay 60% of her 1963 income taxes due to the Vietnam War.

1965: Taking the Pledge

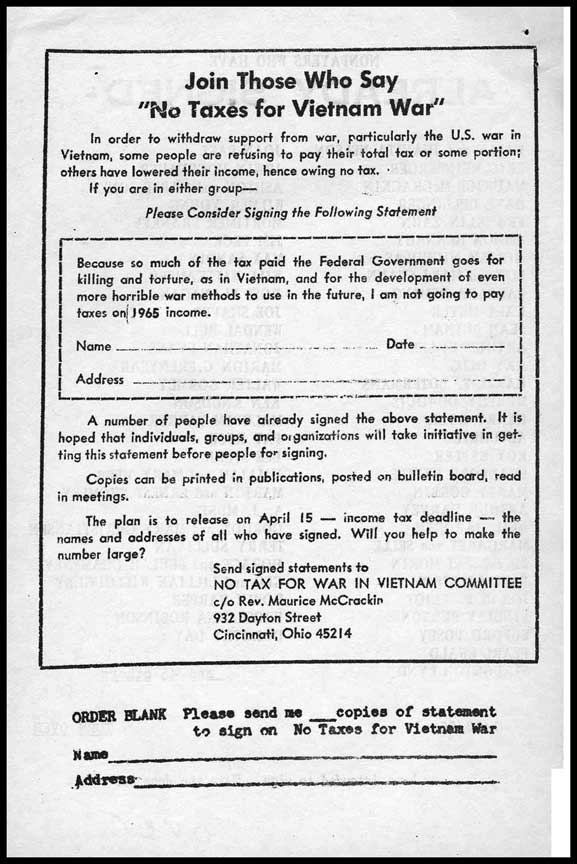

The Peacemakers began No Tax for War in Vietnam Committee and asked people to pledge, “I am not going to pay taxes on 1964 income.” The pledge was continued through 1967, eventually garnering about 500 signatures.

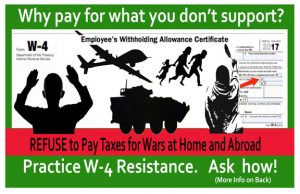

1965: Inflating the W-4 Form

In a 1965 letter to the IRS (reprinted in The Peacemaker [left]) Ken Knudson suggested inflating the W-4 form to stop withholding. National promotion of this strategy by a number of peace organizations resulted in thousands joining the war tax resistance movement. Ultimately — between 1970 and 1973 — 17 people were indicted for claiming too many dependents, 11 were convicted, and 7 were jailed. For the full list of indicted resisters, see www.nwtrcc.org/convicted_wtr.php.

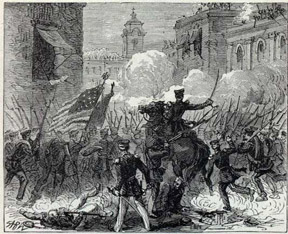

Protesters rallying against the Vietnam War near the University of Wisconsin-Madison campus in 1965

1965: Belgium

On February 28, a petition was sent to the King Baudouin I asking him for a law allowing for conscientious objection to military taxation.

1966: France

The Tax Refusal Movement began as a protest to the first French atomic tests at Moruroa in the Pacific.

1966:

A.J. Muste (center) sitting in at the Atomic Energy Commission headquarters with Miriam Levine (left) and Judith Malina, 1963.

A.J. Muste obtained 370 signatures for an ad in theWashington Post, proclaiming the signers’ intention not to pay at least a portion of the 1965 income taxes.

1966: Angola

Twelve village chiefs refused to cooperate with the Portuguese attempt to collect taxes.

1966: Telephone Tax

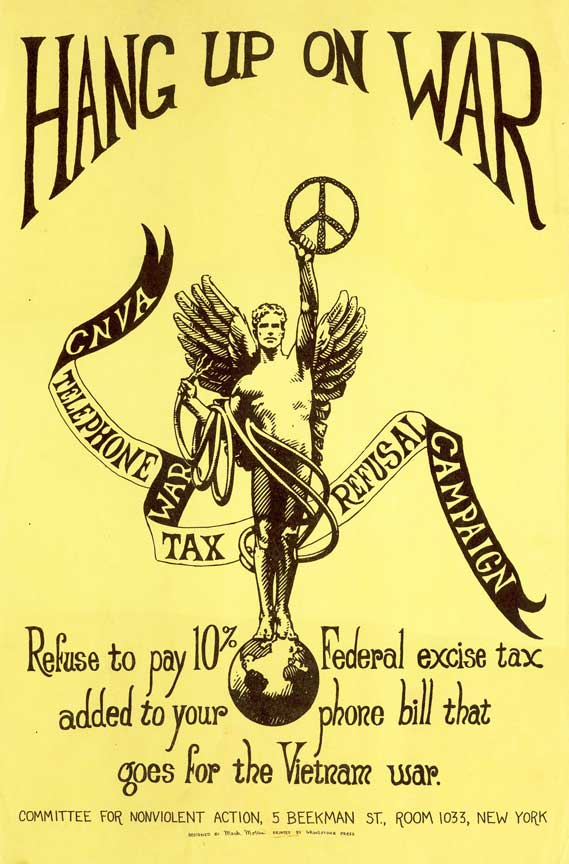

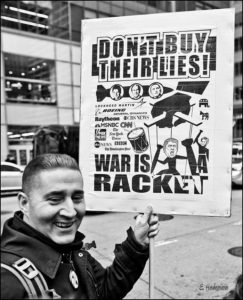

President Johnson asked Congress to reinstate a 10% telephone service excise tax to pay the expenses of deploying a half-million soldiers in Vietnam. Karl Meyer, a Catholic Worker activist in Chicago, recognized the simplicity and directness of urging people to refuse a specific war tax, levied as part of one’s monthly phone bill. His “Hang Up on War” pamphlet was distributed by national peace groups and became the basis of a War Resisters League national campaign.

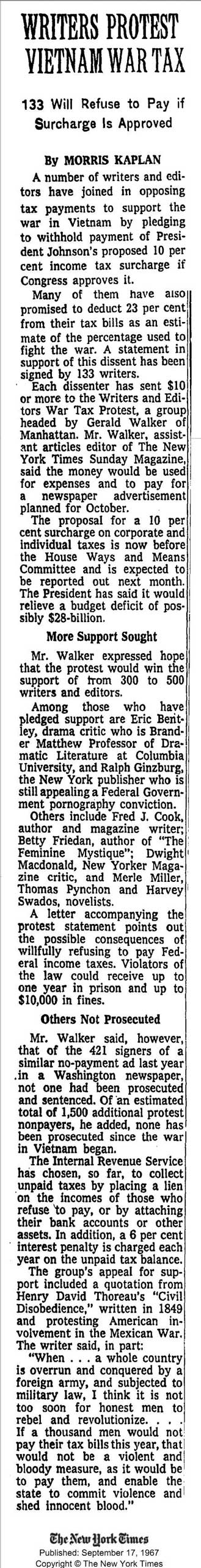

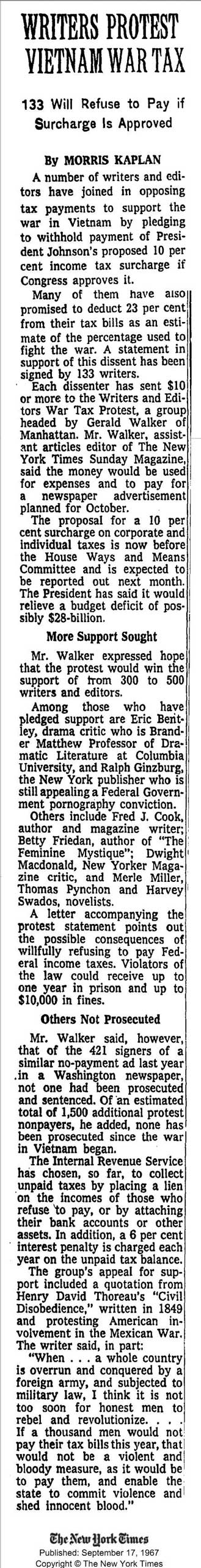

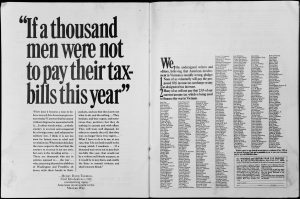

1967: Writers Publicize Their Pledge to Resist

Writers and Editors War Tax Protest was organized by Gerald Walker of The New York Times Magazine. About 528 writers and editors pledged to refuse to pay the 10% Vietnam War tax surcharge. Only three publications — New York Post (Jan. 30, 1968), New York Review of Books(Feb. 15, 1968), and Ramparts magazine (Feb. 1968) — would allow the ad publicizing the effort to be published. The New York Times published an early article about the protest (click on image to the right) on Sept. 17, 1967.

Writers and Editors War Tax ad as it appeared in 1968 Ramparts magazine.

1968: Telephone Tax Victory in Court

The telephone tax resistance case of Martha Tranquilli, Mound Bayou, Miss., led to a decision that telephone service may not be disconnected for nonpayment of federal tax.

Also in 1968, printer and war tax resister Neil Haworth cited the First Amendment to the Constitution for refusing to turn over records to the IRS. He was found in contempt of court and sentenced to and served 60 days in Middlesex State Jail, Conn.

1969: New Organizations Formed

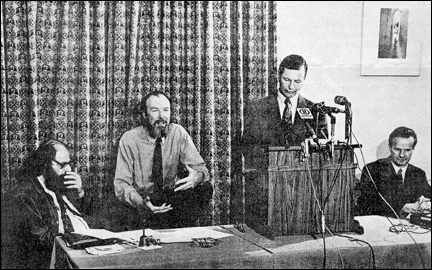

Because the War Resisters League could no longer handle the volume of requests regarding war tax resistance, National War Tax Resistance was formed. A press conference announcing the founding was held in New York City by Allen Ginsberg, Pete Seeger, Kennett Love, and Bradford Lyttle (pictured below). National WTR began publishing Tax Talk (a periodic roundup of news about war tax resisters), produced two editions of a WTR handbook, formed chapters around the country, and lasted until 1975.

The New England War Tax Resistance Alternative Fund began.

The Money Missing from Our Paychecks

by Stephen WingWe who eat

lest we go hungry, we who

lie down to sleep

because we know to the minute

what time we rise,

a bomber is blinking

across our bathroom mirrors that does not sleep,

a sentry walks the perimeter of our dim bedrooms

till the alarm rings

and we reach out to stop it

A truckload of soldiers comes leaping out

into smoke and noise when we

tear open our paychecks every Friday in the bar,

a bomb drops away from the black wing

even while we curse with ritual laughter the government

which has siphoned our blood in the night again

to fuel helicopters and tanks

A distant flame is casting those faint shadows

on the TV screen, a burning

that does not stop for Happy Hour,

while the bodies untangle from the pileup

and the referee bends to retrieve a fumble,

the family scattered

by an American bomb does not get up

The bodies are brown

as the football

waiting at the scrimmage line, but broken

like the field they farmed

they are too busy giving their

blood back to the soil

to blame us, but it is our battle they fight

for every breath, the money missing

from our paychecks every Friday has bought us

the pumping of their hearts to dip our

chips in and wash down

with our beer

it is our war

and only our waking hands can reach out

to stop it.

1900-1959

1917–1919: World War I

During World War I, some members of the Quakers, Brethren, and Mennonites and a few political activists resisted War Bonds and Liberty Loans.

“Being a pacifist between wars is as easy as

being a vegetarian between meals.”–Ammon Hennacy

https://nwtrcc.org/war-tax-resistance-resources/international-history-of-war-tax-resistance/1970s/

Ammon Hennacy (pictured in 1923 passport photo) was imprisoned for two years for refusing to register for the World War I draft, a stand that he repeated at the onset of the second World War. In prison he became a Christian anarchist and pacifist. Hennacy never paid any taxes in his life because of their use in paying for the military and war, and he reduced his tax liability by living in voluntary poverty. He spent years waging peace and teaching that the absence of war is not peace in a country that puts half its tax collections into guns, bombs and the practice of killing.

1930: Salt Campaign in India

The Indian campaign for independence from Britain involved a number of instances of mass tax resistance, including this 24-day, 241-mile march to the coastline to make salt illegally. Thus, M.K. Gandhi began a boycott of the salt laws by millions throughout India.

1941–1945: World War II

With the imposition of federal income tax withholding in 1943 and the 1945 bombings of Hiroshima and Nagasaki, World War II stirred the troubled waters from which the modern war tax movement emerged.

Until World War II, individual income tax was a minor part of the federal government receipts. Income tax returns had a 10% “Defense Tax” added as a result of a Revenue Act of 1940. In 1941, a number of organizations, including Women’s International League for Peace and Freedom and American Friends Service Committee (AFSC), protested.

The 1942 Irving Berlin song sung by Gene Autrey “I Paid My Income Tax Today” promoted payment of taxes for war: “See those bombers in the sky? / Rockefeller helped to build ’em, so did I / I paid my income tax today … A thousand planes to bomb Berlin / They’ll all be paid for and I chipped in.”

The federal government agreed to authorize AFSC to issue Civilian Public Service Bonds and Stamps as an alternative to Victory Bonds and Stamps.

In 1942, Ernest Bromley, Bath, N.C., refused payment of $2.09 and $5 for defense tax stamps required for all U.S.cars. He was arrested and jailed for 60 days. So many cars were driven without the stamps that the law was declared unenforceable and was dropped in 1944.

Then in 1943, payroll withholding was instituted, compelling employers to withhold federal income taxes from workers’ paychecks and pay them to the government, suddenly conscripting the taxes of a huge number of Americans — from 8 to 60 million over a period of six years — into the war effort.

Other war tax resisters during the war and shortly afterwards included Max Sandin (also an imprisoned World War I resister), Walter Gormly, A.J. Muste, Dave Dellinger, James Otsuka, Marion Bromley, Marj Swann, Wally Nelson, Juanita Nelson, Ralph Templin,Milton Mayer, Maurice McCrackin, Fyke Farmer, and Lawrence Scott.

See: Pioneers of the Modern American War Tax Resistance Movement.

1946: New Zealand Resister Jailed

Raymond E. Hansen, Beeville Community, North Island, N.Z., was jailed in 1946 and 1947 for refusal to pay taxes used directly for militarization. In 1949, despite his refusal to pay a £100 fine and £12 in court costs, he was not jailed again.

1947: Fellowship Magazine

The first article on war tax resistance — “The Case for Tax Refusal” by Ernest Bromley — appeared in Fellowship magazine, published by the Fellowship of Reconciliation.

1948: Peacemakers

A conference on “More Disciplined and Revolutionary Pacifist Activity” was held in Chicago. Peacemakers, the first organization to promote war tax resistance, grew out of the conference. The organization published “News of Tax Refusal” (1949–1952) and The Peacemaker (1949–1992) on war tax resistance.

Two approaches to war tax resistance emerged at this time: one was to earn so little money that no taxes were owed, and the other was to refuse to pay all or part of their taxes on the grounds that a large portion supported the war effort.

Wally Nelson, Juanita Nelson, Ernest Bromley, Marion Bromley, Maurice

McCrackin. Photo: Ed Hedemann.

1949: Contempt of Court

James Otsuka, Richmond, Ind., a World War II draft resister, was the first of only two people in modern times jailed for refusal to pay war taxes ($4.50) as well as contempt of court for refusal to turn over records to the IRS. He was sentenced to 3 months and $100 fine but spent 4 and a half months in jail, finally released on Jan. 16, 1950.

1951: First Telephone Tax Refuser Protests Korean War

Franklin Zahn (pictured here in 1959) became the first telephone war tax resister by refusing the 15% federal tax during the Korean War. When the refused tax reached $1.59, Bell Telephone disconnected his telephone service. Zahn continued refusal until the end of war in 1953, then resumed his refusal during the Vietnam War.

1951: First Car Seized

In 1951, Walter Gormly, Mt. Vernon, Iowa, was the first person to have a car seized and auctioned by the IRS for nonpayment of war taxes.

1957: First House Seized

In 1957, Raymond and Jean Olds, Yellow Springs, Ohio, were the first people in modern times to have their house seized by the IRS for nonpayment of war taxes ($160). They also had a truck seized the same year.

1958: Noncooperation

Another Peacemaker, Cincinnati Presbyterian minister Maurice McCrackin, spent six months in jail for refusing to turn over his financial records to the IRS and noncooperating with court proceedings. He was released in May 1959. His response pioneered the art of complete non-cooperation.

1959: Jailed for War Tax Resistance

Juanita Nelson was the first U.S. woman jailed for war tax resistance. She was released the same day as the arrest. The IRS never collected any money. The story of her arrest, “A Matter of Freedom,” was published in Liberation magazine.

2000s

The 2000s

2003: Julia Butterfly Redirects $150K – Largest Ever

https://nwtrcc.org/war-tax-resistance-resources/international-history-of-war-tax-resistance/2000s/

“The greatest changes in history have only come when people are willing to put everything on the line.”

—Julia Butterfly Hill

While marching in the financial district in San Francisco to protest the impending Iraq invasion, celebrated tree-sitter and author Julia Butterfly Hill chose to take another stand: she would resist her full $150,000 federal tax liability (the result of a significant legal settlement). She donated that money to after school programs, arts and cultural programs, community gardens, programs for Native Americans, alternatives to incarceration, and environmental protection programs. In her press statement she said, “I am not avoiding paying taxes. I have thought through this very carefully, and with a clear mind and heart I am humanely redirecting my tax payments to where they belong, because our current federal government refuses to do so.” You can see her appearance in NWTRCC’s film Death and Taxes here. She remains active — check out her website.

2003: Online “Hang Up On War” Campaign Begins

Iraq Pledge of Resistance, War Resisters League (WRL), and NWTRCC created Hang Up On War! to resist the U.S. war on and occupation of Iraq and to oppose the larger policies of “pre-emptive war” and the “endless” war on terrorism. While the federal tax on a monthly telephone bill is relatively small, this tax raised $89 billion from 1966 to 2001, and about $6 billion per year until 2006 when the tax was dropped from long distance calls (it remains on local phone bills).

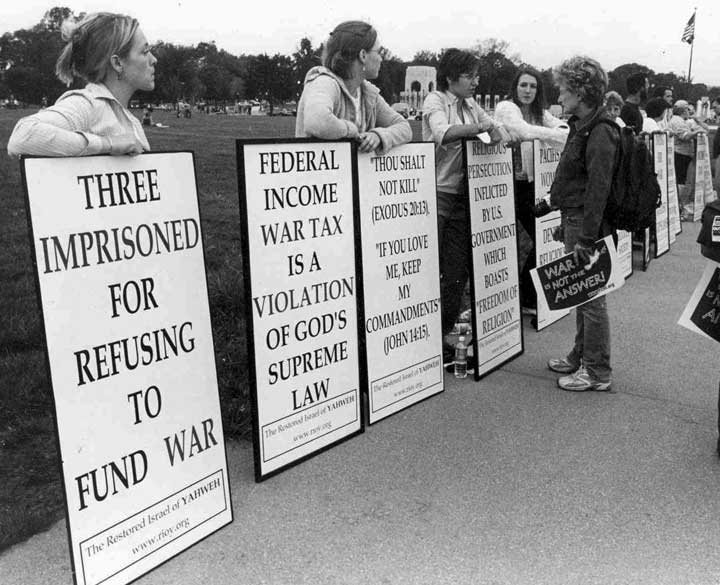

2004: Restored Israel of Yahweh Members Convicted

Kevin McKee, Joe Donato, and Inge Donato were convicted by a jury in federal court in Camden, New Jersey, on charges including “conspiring to defraud the United States” and “attempted evasion of employment taxes.” (The latter charges, along with that of failure to file personal income tax returns, were later overturned on appeal.) They were the first war tax resisters to be convicted of these most serious criminal charges in the Internal Revenue Code due to their religious beliefs. Theirs also were the longest sentence received for such “crimes.” In particular, they were singled out for failing to withhold and pay over the employment tax on the McKee-Donato Construction Company employees who were fellow members of the Restored Israel of Yahweh, a small unaffiliated Bible-study based religious society in southern New Jersey, which has a long history of refusing to support war and military taxes due to their religious beliefs.

2005: Attorney J. Tony Serra Released

Renowned criminal defense lawyer J. Tony Serra was convicted of the misdemeanor “failure to pay” $44,000 for tax years 1998 and 1999 and sentenced to ten months and $100,000 (what the IRS guessed he owed over a five-year period). He was one of only two war tax resisters since World War II to have been jailed on such a charge. He served nine months in Lompoc Federal Penitentiary in California and a month in a halfway house. Twice before — in 1974 and 1986 — Serra had been convicted because of his war tax resistance. Click here for a profile of him and his resistance to authority.

2006: Peace Tax Fund Campaigner Marian Franz Dies

“They kill twice. First, they directly enable war . . . particularly paying for weapons. Second, taxes allocated for war represent a distortion of priorities. Money is taken away from the important work of healing and is spent to destroy and kill.”

—Marian Franz (1930–2006) on war taxes

For 24 years Marian Franz was the Executive Director of the National Campaign for a Peace Tax Fund (NCPTF), which works for lawful recognition of the right of conscientious objection to military taxation (COMT). With tremendous energy and vision, broad knowledge, and wonderful gifts of writing and speaking, Marian balanced effectively both leadership of NCPTF and lobbying in Congress for the Religious Freedom Peace Tax Fund Bill.

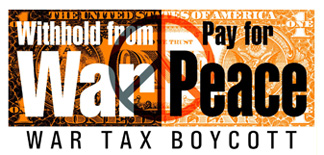

2007: War Tax Boycott Launched

In its first year the War Tax Boycott publicly registered over 500 people, many of whom decided to do war tax resistance and redirection for the first time. Since 2007 signers to the War Tax Boycott have redirected over $400,000 to humanitarian programs, including medical aid for Katrina survivors, support for Iraqi refugees in Jordan, food banks, programs for the homeless, books for prisoners, environmental projects, peace groups, and hundreds of other nonprofit organizations in the U.S. and around the world.

2009: The Peace Tax Seven Case Refused

“The right of conscientious objection to conscription to military service has been recognized in most democracies, including in the U.K. in the Military Service Act (1916). The right not to pay taxes for military purposes is a logical extension of the right to refuse to take part in active military service.”

—The Peace Tax Seven, U.K.

The European Court of Human Rights in Strasbourg refused to consider the Peace Tax Seven’s application for a judicial review of British law relating to military taxation under the European Convention on Human Rights. The Court’s refusal was not subject to appeal and brought to an end a five-year national and international legal campaign by seven war tax resisters in Britain.

2010: Death and Taxes Film Released

NWTRCC produced the new film Death and Taxes, which introduces people to war tax resistance/refusal through the stories and explanations of 28 active resisters and experts.

Recent Posts

- The Streets of New York, The Letter in the Mailbox April 18, 2024

- My Letter to the IRS April 11, 2024

- Busting through the Bottom Line March 15, 2024

- Resisting War Taxes in the Gig Economy March 7, 2024

- Tax Day 2024- Here we Come! February 29, 2024

Taxes for Peace New England is again looking forward to tabling on Tax Day at the Brattleboro (VT) Food Co-op. That said I continue to wonder as I have for the past eight or so years: Why the focus on April 15th events? It’s never made much sense to me to tell people about tax resistance the day taxes are due, most people have already turned in their taxes. Seems more realistic to tell people about WTR in January/February.

Lindsey,

Great points! You definitely are not alone in raising these questions. While tax day has been a time to mobilize actions to raise awareness about how much of our federal income taxes goes towards militarism, NWTRCC continually raises these points year round. Focusing on the needs within our communities and redirecting resources to these needs are practices that people can engage in year round. This year NWTRCC has been hosting regular introductions to war tax resistance since November to assist people pursuing this path and ensuring adequate time to prepare.